Introduction

In today's ever-evolving economic landscape, the construction and contracting industries are more competitive than ever. Contractors, whether they're involved in residential, commercial, or specialized trades, face numerous responsibilities and risks. One of the best ways to mitigate these risks while building trust with clients is through contractor bond insurance. This article delves deep into the intricacies of contractor bond insurance and why it's essential coverage for every trade.

Contractor Bond Insurance: Essential Coverage for Every Trade

Contractor bond insurance serves as a crucial safety net for contractors across various trades. It's not merely an additional cost; it's an investment that can protect your business from potential losses, legal disputes, and damage claims. In essence, it assures clients that you are committed to fulfilling your obligations.

As the construction industry continues to grow, so does the complexity of projects. With this complexity comes the increased possibility of unforeseen issues—issues that can lead to substantial financial losses if not adequately covered. So what exactly is contractor bond insurance? Let's break it down.

What is Contractor Bond Insurance?

Understanding the Basics of Contractor Bond Insurance

At its core, contractor bond insurance is a type of surety bond that protects clients against contractor defaults or failures. It acts as a guarantee from the bonding company that they will compensate clients if a contractor fails to complete their work according to the agreed-upon terms.

Types of Bonds in Contractor Bond Insurance

There are generally three types of bonds associated with contractor bond insurance:

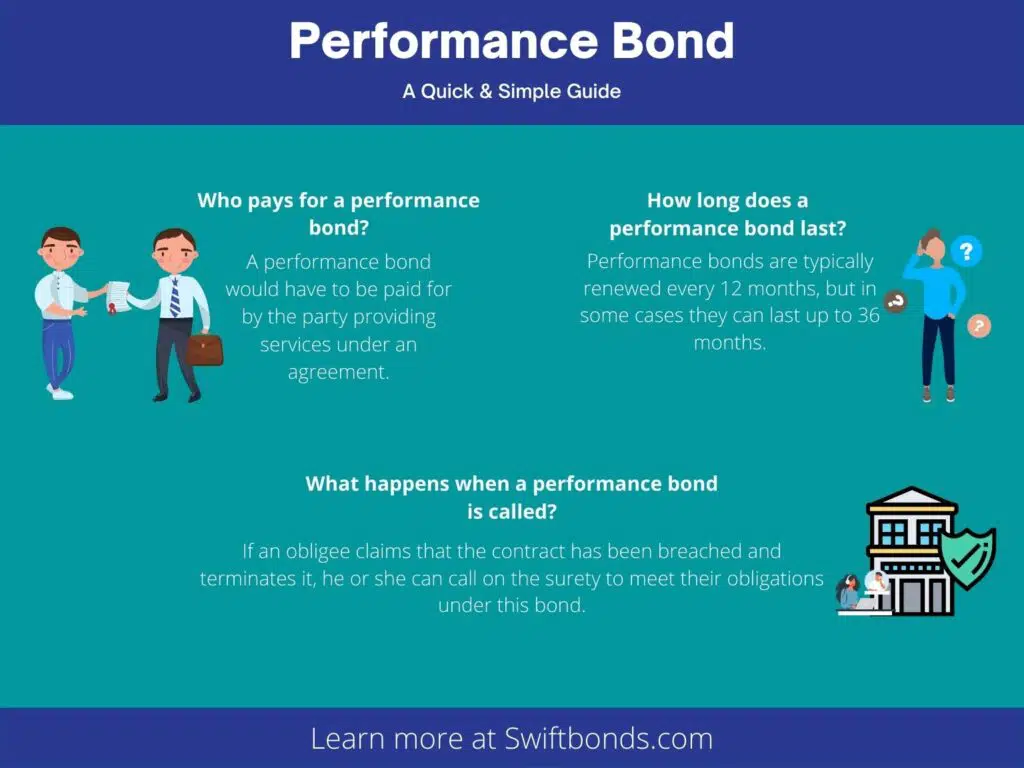

Bid Bonds: These ensure that a contractor who wins a bid will undertake the project as specified. Performance Bonds: These provide assurance that a contractor will complete their work according to the contract specifications. Payment Bonds: These protect suppliers and subcontractors by guaranteeing payment for services rendered.Why Is Contractor Bond Insurance Important?

Building Trust with Clients

Having contractor bond insurance signals to potential clients that you're serious about your responsibilities and obligations. It shows them that you're financially stable and willing to go the extra mile to ensure project completion.

Legal Protection Against Disputes

With contracts come legal agreements, and disputes can arise at any time. Contractor bond insurance helps shield you from legal liabilities associated with incomplete or unsatisfactory work.

Securing Larger Contracts

Many larger projects require contractors to possess specific bonds before bidding. Without contractor bond insurance, you may find yourself excluded from lucrative opportunities.

How Does Contractor Bond Insurance Work?

The Process Explained

Application: Contractors apply for a bond through a surety company. Underwriting: The surety company evaluates your financial stability, experience, and reputation. Issuance: If approved, the surety company issues the bond. Claim Process: If there's a default on your part, clients can file a claim against your bond.Key Players in Contractor Bond Insurance

- The Principal: The contractor applying for the bond. The Obligee: The party requiring the bond (typically the client). The Surety: The bonding company providing assurance.

Common Myths About Contractor Bond Insurance

Myth 1: All Contractors Need It

While many contractors benefit from having it, not every trade requires contractor bond insurance by law.

Myth 2: It's Too Expensive

The cost varies based on several factors like credit score and project size; however, it's often worth it compared to potential losses without coverage.

Factors Influencing Contractor Bond Insurance Premiums

Credit History and Financial Standing

Your credit score plays a significant role in determining premiums. A higher score usually translates into lower rates.

Experience Level in Your Trade

More experienced contractors typically enjoy lower premiums due to established reputations and proven track records.

Project Size and Scope

Larger projects often entail higher premiums because they pose greater risks for both contractors and clients alike.

How to Obtain Contractor Bond Insurance? Step By Step Guide

Step 1: Evaluate Your Needs

Understand which types of bonds you require based on your trade and projects.

Step 2: Research Surety Companies

Look for reputable companies specializing in contractor bonds.

Step 3: Gather Documentation

Prepare necessary documents such as financial statements, resumes showcasing experience, and any other license and permit bonds relevant information required by your chosen surety company.

Step 4: Apply for Your Bond

Submit your application along with all documentation gathered previously.

Step 5: Review & Sign Agreement

Once approved, review the terms thoroughly before signing off on your coverage agreement.

Frequently Asked Questions About Contractor Bond Insurance

Q1: What is typically covered under contractor bond insurance?

A1: Typically covers project completion guarantees (performance), bid submission adherence (bid), and payment assurances (payment).

Q2: How long does it take to get bonded?

A2: Generally ranges from one day up to several weeks depending on various factors including documentation readiness and underwriting processes.

Q3: Can I cancel my contract after obtaining coverage?

A3: Yes, but there may be penalties or fees involved depending bonds for licenses and permits on terms outlined in your agreement with the surety company.

Q4: Do subcontractors need their own bonds?

A4: Yes! Subcontractors often need separate bonds especially when working under larger contracts requiring multiple layers of bonding protection.

Q5: What happens if I default on my obligations?

A5: If you default, clients can submit claims against your bond; if approved they receive compensation which you may then owe back to surety company later!

Q6: How do I choose between different providers?

A6: Compare rates but also consider each company's reputation within industry circles; reviews from past customers carry weight too!

Conclusion

In summary, contractor bond insurance is not just another expense—it's an invaluable asset that safeguards both contractors and their clients alike in today's competitive market landscape. Whether you're bidding on large-scale commercial jobs or smaller residential projects across various trades—having this type of coverage ensures peace of mind while solidifying trustworthiness among potential clientele! Don't overlook how essential this could be as you navigate through complexities tied directly into contracting practices moving forward!

By understanding its significance fully along with navigating processes effectively—you'll position yourself ahead within competitive fields enabling future successes!